Executive Chairman, Enugu State Internal Revenue Service (ESIRS), Mr Emmanuel Nnamani, said this while reacting to the Mortuary Tax circular addressed to all the Mortuary Attendants in the state trending online.

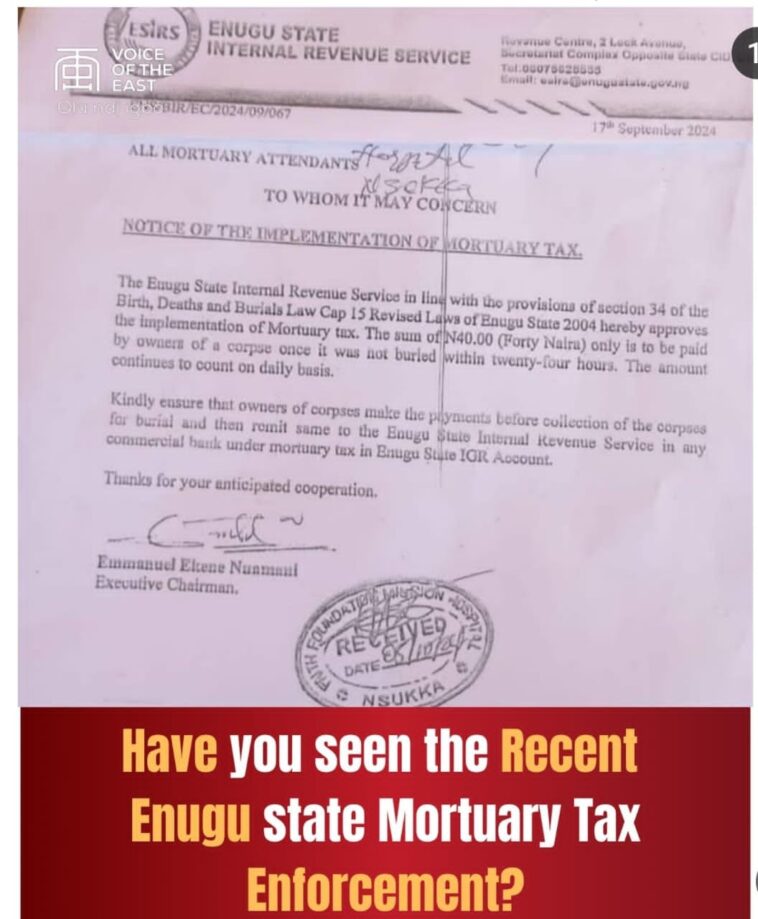

According to the circular, ESIRS in line with the provisions of section 34 of the Birth, Deaths and Burials Law Cap 15 Revised Laws of Enugu State 2004, hereby approves the implementation of Mortuary tax.

“The sum of N40.00 only is to be paid by owners of a corpse once it was not buried within twenty-four hours. The amount continues to count on a daily basis.

According to the circular, ESIRS in line with the provisions of section 34 of the Birth, Deaths and Burials Law Cap 15 Revised Laws of Enugu State 2004, hereby approves the implementation of Mortuary tax.

“The sum of N40.00 only is to be paid by owners of a corpse once it was not buried within twenty-four hours. The amount continues to count on a daily basis.

“Kindly ensure that owners of corpses make the payments before collection of the corpses for burial and then remit same to the ESIRS in any commercial bank under the mortuary tax in Enugu State IGR Account,” the circular said.

Reacting to concerns raised Nnamani explained that the tax was not new to the state, adding that it was within the Enugu State Mortuary Tax Law which had been in existence for years

He also alleged that some social media users changed the date on the circular to make it look like a new thing, clarifying that the amount to pay was only N40, not N40,000.

“It is an indirect tax paid by mortuary owners, not deceased family and it is just N40, not N40,000. Since its introduction, nobody has been denied burying their dead ones.

“It means that that if a corpse stays in the mortuary for 100 days the mortuary is expected to pay to state a sum of N4,000.

“The tax is not meant to generate revenue but to discourage people from taking their dead ones to the mortuary all the time,” Nnamani stressed.